The Latest on Inflation

News and updates

This page intends to point out and illustrate the latest news on inflation in Europe.

It refers to newspapers, magazines, and specific examples.

Successful Swiss National Bank

March 2024:

While the Swiss National Bank (SNB) is in search for a successor to Thomas Jordan, leaving in September this year, its track record regarding inflation stands out positively.

Reading:

Bloomberg

Service Sector Inflation

March 2024:

The latest report by the Bank for International Settlements (BIS) highlights that the rising prices of (labor-intensive) services could imply that inflation is sticky - if nations enter a price-wage spiral.

Reading:

BIS

Falling Global Inflation

February 2024

Looking at the average global rate of inflation we continue to see a downward trend - although it appears to stabilize at a level higher than before the recent wave of high inflation.

Reading:

Bloomberg

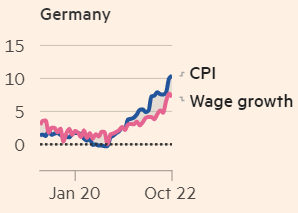

High Wage Growth

February 2024

Central banks are reluctant to declare victory over inflation partly because wage growth remains high. If labor costs are passed on to consumers, economists ware of a wage-price spiral.

Reading:

Financial Times

(Mis-) Measuring Inflation

February 2024:

It is notoriously difficult to measure inflation. What fraction of their income people spend on various goods & services changes (partly in response to changing prices) and also the goods & services themselves change. A recent article by Allysia Finley from the WSJ points out the implications of 'shrinkflation'.

Reading:

WSJ

Falling House Prices in Germany

November 2023:

House prices in Germany are falling sharply while the number of new building permits is lower than at any time in the last decade.

Reading:

Financial Times

Governments brace for fiscal reckoning

November 2023:

If interest rates are indeed higher for longer to fight inflation, governments will find it harder to finance large public deficits. In the words of Jim Leaviss, CIO of public fixed income at M&G Investments, "Deficits are why people talk about bond vigilantes coming back — the idea that bond markets will act as a constraint on fiscal spending"

Reading:

Financial Times

Inflation lower but plateauing

October 2023:

The most recent inflation numbers in G7 countries show a definite slowdown from six months earlier. But there are regional particularities, and recent months have seen an inflation "plateau," or even moderate acceleration.

Reading:

Macrobond

Global tightening cycle might be over

September 2023:

policymakers in the US, UK, Japan, and Switzerland all decided to keep rates on hold. Does this imply that the global cycle of rate rises is over? The Financial Times discusses this today.

Reading:

Financial Times

What drives Euro area inflation?

August 2023:

The ECB released charts showing what contributes to the Euro area's rate of inflation. Since energy prices no longer contribute, headline inflation has fallen from above ten to about six percent.

In contrast, core inflation remains at a high level of four percent.

Reading:

ECB

Eurozone money supply shrinks

August 2023:

Eurozone money supply has shrunk for the first time since 2010 as private sector lending stalls and deposits decline. More data on this in the Money Supply section.

Reading:

Financial Times

Rising German Wages

August 2023:

German wages rose at a record annual rate of 6.6 percent in the second quarter of 2023, up from 5.6 percent in the previous quarter. This could be a sign that a wage-price spiral has took off.

Reading:

Financial Times

Service Sector Inflation

August 2023:

There are intense debates about whether or not additional monetary tightening is necessary to bring inflation down. Looking at prices in the service sector, especially in the Euro area we still observe high rates of inflation.

Falling Headline Inflation Rates

June 2023:

A rising number of countries experience dis-inflation, that is to say: rates of consumer price inflation are still positive but falling.

Reading:

Macrobond

High Food Prices

June 2023:

Consumers in many countries are upset about high food prices. Data from the OECD indicates that only Switzerland enjoys a modest increase while most nations see food prices 20-30 percent above January 2021 levels.

Reading:

OECD

Comparison EA, CH, US

June 2023:

Headline CPI rates of inflation are falling the Euro area, Switzerland, and the US. However, core inflation has plateaued at 5 percent in the Euro area and the US, as well as at 2 percent in Switzerland.

Inflation forecast to stay elevated

June 2023:

In its latest economic outlook, the OECD does not see inflation falling below 2% in either 2023 or 2024.

Reading:

OECD

Falling Headline Inflation, Rising Core Inflation

June 2023:

While headline inflation rates fall in both the Euro area and the US (partly due to the base effect), core inflation remains high (US) or is even increasing (EA).

Reading:

ECB

Falling House Prices in Europe

May 2023:

House prices are falling in several European nations. The latest data from Q4 of 2022 indicate a 6-7% fall in Denmark, Germany, and Sweden as well as a 10-12% reduction in Italy and Greece.

Reading:

OECD

Falling Producer Prices still high

May 2023:

After climbing 50% in a short period of time, producer prices in the Euro area's industry are now falling. Yet, they are still 42% above the April 2020 level.

Reading:

Eurostat

Inflation increases again in the Euro area

May 2023:

The latest data from Eurostat indicate that inflation increases slightly from 6.9 to 7.0 percent. The contributions are shifting from energy to services.

Reading:

Eurostat

Falling House Prices

March 2023:

The German statistical office released data on housing prices in Q4 2022, confirming that the decade of increases is over (see Indicators).

Reading:

DeStatis

Food Price Inflation in Germany

March 2023:

The latest inflation data from Germany indicate that within twelve months, food prices increased by 21.8 percent. This is by far the highest value since the introduction of the Euro.

Reading:

Deutsche Welle, Eurostat

Inflation Momentum

March 2023:

In a new presentation, the ECB provides a detailed account of what they call "underlying inflation". The charts indicate that while there is "a clear turnaround in energy inflation, momentum for core inflation has not declined".

Reading:

ECB

Euro Area core inflation continues to rise

March 2023:

Core inflation - which excludes food and energy prices - in the Euro area rose to 5.6 percent, up from 5.3 percent in the previous month. The latest data indicate that almost 9 in 10 goods and services face a rate of inflation in excess of the 2 percent target (see indicators).

Reading:

Financial Times

BIS Warning on Inflation

February 2023:

The Bank for International Settlements (BIS) emphasized the difficulty of bringing inflation down. Claudio Borio, head of the monetary and economic department, said it is "much easier to get inflation from 8 per cent to 4 per cent when the work is done by [falling] commodities prices, than it is to get it from 4 per cent to 2 per cent, which is the part that central banks will have to do".

Hyun Song Shin, the BIS's head of research, added that the "reason central banks have been emphazising [the importance of] going the last mile on bringing inflation down is that, if you are not fully back to target and relax too early, you will undo all the work you have done before".

Reading:

Financial Times

Food Price Inflation

February 2023:

Inflation is the Euro area is now mainly driven by food prices. Of the 8.6% inflation in January 2023, almost 3 percentage points came from food alone, followed by energy (2.2 percentage points), services (1.8), and industrial goods (1.7).

Reading:

The Economist

Inflation continues broadening

February 2023:

Inflation in both the Euro area and Switzerland is broadening in the sense that a larger share of the basket of goods & services used to calculate inflation sees substantial price increases. For the Euro area, more than 85% of goods & services face inflation above 2%, about 63% more than 5%. In Switzerland, 56% of items have increased by 2% or more within a year and 33% increased by 5% or more.

Reading: Indicators

Inflation Expectations

January 2023:

New data from the European Central Bank indicates that consumers expect inflation in the coming years to be 2.9 and 4.6 percent (mean to median range) - substantially above the ECB's target of 2.0 percent. The small drop in the latest survey is seen as a positive sign.

Reading:

ECB

Risky European Debt

December 2022:

New research published by Bruegel shows (i) the Next Generation EU plan substantially increases EU debt and (ii) EU debt is considered far more risky than that of Germany.

Reading:

Bruegel

ECB Inflation Forecast

December 2022:

According to the latest ECB forecast, inflation in the Euro area will only come down to 2% in Q3 of 2025 (see indicators). This implies that from Q1 2020 to Q1 2025, in just five years, the Euro loses a quarter of its purchasing power.

Reading:

ECB

Falling Container Freight Rates

December 2022:

Prices for international container shipping peaked in summer 2021 and have fallen sharply ever since. The composite index today is about a quarter of its peak value.

Reading:

MacroMicro

Shrinking CB Balance Sheets

December 2022:

There are first signs that central banks are reducing their balance sheets. The latest data from the Federal Reserve, the European Central Bank, the Bank of Japan, and the Swiss National Bank are all below peak.

Reading:

Financial Times

Rising Food Prices

December 2022:

Food price inflation continues to grow. The latest Eurostat data from October indicate that food in Germany got almost 20% more expensive within a year.

Reading:

Eurostat

Falling Oil Price

November 2022:

One reason why rates of inflation could possibly decrease somewhat in the near future is that energy prices have not continued to increase. The oil price, for instance, is down around a third from its peak earlier in 2022.

Other commodity prices are also easing (see Indicators), leading to reduced PPI.

Eurozone Wage Growth Accelerating

November 2022:

New data from job ads indicate increased wage growth in the Euro area. Median pay is 7 percent higher than a year ago in Germany. This could signal the beginning of a wage-price spiral.

Reading:

Financial Times

Euro Area Inflation jumps to 10.7 percent

October 2022:

The latest data from Eurostat documents another record for the rate of consumer price inflation in the Euro area. All three major economies - France (7.1), Germany (11.6), and Italy (12.8) - are far above the 2% target.

Reading:

Eurostat

Inflation 10% in Euro Area, 3.3% in Switzerland

October 2022:

The inflation developments in the Euro area and Switzerland diverge further: While the EA sees a jump to 10.0%, Switzerland observed a reduction to 3.3% in September.

The Great Tightening

September 2022:

The renowned weekly magazine The Economist discusses the "great tightening" - central banks raising interest rates. Moreover, the author points out the lack of international coordination.

Reading:

The Economist

Shrinking Central Bank Balance Sheets

September 2022:

Data compiled by Macrobond illustrates that major central banks have started to shrink their balance sheets to combat soaring inflation.

Reading:

Macrobond

Rising Inflation Expectations

September 2022:

The ECB's Consumer Expectations Survey reveals that for the next 12 months, people expect on average seven percent inflation (median: five percent).

Reading:

ECB

Drivers of Global Inflation

September 2022:

The International Monetary Fund analyzed the drivers of inflation for 88 countries. As the chart indicates food and energy are the main factors.

Reading:

IMF

Inflation Top Public Concern

August 2022:

Inflation is the number one global concern according to Ipsos. In July, 38% said it is one of the top issues facing their country today. The market research firm conducted surveys across 27 countries between June 24 and July 8, 2022.

Reading:

Ipsos

Anti-Fragmentation in Action

August 2022:

Newly released data by the ECB indicate that the central bank has used funds freed up by maturing debt to purchase Southern European debt, pushing their yields down. "Net holdings in German, French and Dutch bonds dropped by 18.9 billion euros ($19.3 billion) through July. Net purchases of debt from Italy, Spain, Portugal and Greece totaled 17.3 billion euros."

Source of image and reading:

Bloomberg

OECD Inflation above 10%

August 2022:

Consumer prices in OECD countries, a club of 38 rich countries, rose above ten percent. This is the first time since the late 1980s.

Reading:

OECD

Record-High Inflation in the Euro Area

July 2022:

The latest update from Eurostat shows 8.6% inflation in June, far above the 2% goal stated by the European Central Bank.

Reading:

Eurostat

Surging Producer Prices

June 2022:

Producer prices in Europe's largest economy continue to surge. The latest update shows an increase by 33.6% year-on-year. A new all-time record.

Reading:

DeStatis

New Public Debt Crisis?

June 20222:

As bond yields climb everywhere, Credit Suisse analyzed the risk of a new public debt crisis. The data shows how governments have exploited the record-low interest rates of recent years to extend the average maturity of their debt portfolios and lock in the benefit of low interest rates for a longer period.

Reading:

Credit Suisse

Rising Bond Yields

June 2022:

A saying in London pubs has it that there is no number between two and six. The same might hold for Italian bond yields. At 3.65 percent, they are now higher than during the short peak following ECB President Lagarde's comments in spring 2020.

Reading:

MarketWatch

Supply Chain Pressure

June 2022:

The latest update on the supply chain pressure index shows a modest decrease but is still at a very high level compared to previous years.

Reading:

Liberty Street Economics

Euro Area Inflation

June 2022:

Currently, we see four record numbers for inflation in the Euro area. The maximum, the minimum, and the average rate of CPI inflation are at a record high. On top, the difference between the lowest and highest rate was never that large.

Reading:

Cash.ch

Stronger US Dollar

May 2022:

The US Dollar has recently started to surge in value. Both the Euro and the Swiss France depreciated strongly. This will raise energy prices in Europe.

Reading:

Indicators

Wage-Price Spiral?

May 2022:

The Bank for International Settlements (BIS) examines whether major advanced economies are on the verge of a wage-price spiral.

If inflation remains high, households may ask for higher wages and firms may raise prices. And stubbornly high inflation may lead to institutional changes such as automatic indexation and cost-of-living adjustment clauses.

Reading:

BIS, May 4, 2022

Industrial Producer Prices in the Euro Area

May 2022:

Eurostat just announced that industrial producer prices in the Euro area are up 36.8% compared with a year ago.

Reading:

Eurostat, May 3, 2022

Surging Food Prices

April 2022:

The Food and Agriculture Organization of the United Nations Food Price Index surged in March to a new highest level since its inception in 1990.

Reading:

FAO, March 10, 2022

German Inflation at 7.6%

March 2022:

The Federal Statistical Office in the largest Euro economy expects 7.6% inflation for March 2022, a 40-year high for Germany.

Reading:

DeStatis, March 31, 2022

30-Year High Inflation in the UK

March 2022:

The government has set the Bank of England a target of keeping inflation at two percent. Yet, the latest reading shows 6.2%, a 30-year high.

Reading:

ONS, March 23, 2022

Global Commodity Prices rally

March 2022:

The latest data indicate that global commodity prices are on track for the biggest weekly rally in more than fifty years. Prices have doubled since April 2020.

Reading:

Financital Times, March 3, 2022

Producer Prices in Germany surge

February 2022:

Producer prices in Germany in January 2022 were 25% higher than in January 2021. This was by far the largest increase in ever recorded. The dashed line shows 2%.

Reading:

DeStatis, Feb 21, 2022

ECB discusses House Price Inflation

February 2022:

ECB executive board member Isabel Schnabel tells the FT that the house price surge 'cannot be ignored'. However, the key ECB measure for inflation does so - and will continue to do so.

Reading:

Financial Times, Feb 16, 2022

Asset Price Inflation in Germany

February 2022:

Flossbach von Storch reports asset price inflation in Germany at 9.2% in the year of 2021. There is a decline in Q4, yet inflation remains exceptionally high.

Reading:

FvS, Feb 15, 2022

House Price Inflation feeds CPI Inflation

February 2022:

New research by the San Francisco Fed provides empirical support for the idea that changes in house prices ("asset price inflation") predict CPI inflation a year later: "This prediction translates into an additional 1.1pp increase in overall CPI inflation for both 2022 and 2023."

Reading:

Fed, February 14, 2022

Record-High Producer Price Inflation in Germany

February 2022:

The German Federal Statistical Office (Destatis) reports that in December 2021, the index of producer prices for industrial products increased by 24.2% compared with December 2020, 10.4% when excluding energy.

This was the highest increase ever.

Reading:

DeStatis, Feb 10, 2022

Rising European bond yields

February 2022:

The ECB's refusing to rule out a potential rate rise this year contributed to higher borrowing costs for eurozone governments.

Reading:

Financial Times, Feb 7, 2022

US inflation at 40-year high

January 2022:

Consumer prices in the United States grew by 7.0% in 2021. This marks the highest rate of inflation since 1981.

Data from the US BLS.

Highest rate of inflation ever in the Euro area

January 2022:

According to Eurostat, with 5.0% the rate of consumer price inflation (HICP) is at an all-time high.

Reading:

Financial Times, Jan 7, 2022

Asset Price Inflation in Germany at Record High

November 2021:

Prices for assets owned by German households have risen by +12.1% compared with the same quarter a year earlier. This is the highest price increase since the start of the time series in 2005. Assets are now almost 30% more expensive than in 2017.

Source:

Flossbach von Storch

Special Bloomberg issue on inflation

November 2021:

Bloomberg Businessweek features a special report on inflation.

"The fear is real. But maybe the monster is not."