The Story of Inflation

Why everyone talks about it, what has happened, and what to expect in the future

There is no denying that inflation is back in the news. In late 2021, the The Guardian wrote that UK inflation jumped to a 10-year high, the highest level since September 2011. Meanwhile the Financial Times pointed out that the rate of inflation in the Euro area was 5.1% in January 2022, a record in the common currency's history.

The UK and Eura area are no exceptions. In rich OECD countries, inflation hit a 25-year high in late 2021. The rate of inflation hit 6.6% in December 2021.

And it is not just consumer prices that are rising. According to the German Statistical Office, "in the third quarter of 2021, prices of residential property in Germany rose by an average of 12.0% year on year. This was the largest increase in the prices recorded for residential property transactions for the second time in a row since the beginning of the time series in 2000."

Inflation is back. And it matters for everyone because it has far-reaching effects on the wellbeing of people and the profitability of companies. It has pros and cons (see background).

So, why does it occur and will inflation indeed be "temporary" as so many central banks insist? To analyze this, we must first take a look at history, then understand the monetary system of today.

This page is intended to provide an easy-to-follow account of these matters, accompanied by up-to-date charts of the relevant data.

The History of Inflation

Inflation is as old a phenomenon as money itself.

In the most primitive economies, thousands of years ago, people traded goods for goods. One farmer, for example, traded 2 loafs of bread for 4 apples with another farmer.

This shows: prices are exchange ratios. The price of one bread in our example is two apples. In general, prices back then were determined by supply and demand - or as economists say, by scarcity. Something is scarce if there is more demand than supply.

In years with a good apple harvest, for instance, the supply of apples was ample and as a result they were cheap. In contrast, when the harvest was bad and there was a "shortage of apples", the price of apples went up. Notice, however, this implies that other goods become cheaper. Two loafs of bread were, for example, traded for two apples (instead of four). You needed more bread to obtain apples but fewer apples to obtain a loaf of bread. There was no inflation, no general increase in prices.

If there was a producer of apple juice who buys apples, he would face an increase in "costs" due to the bad apple harvest. Trying to pass on this cost increase to his customers, he might justify the higher price of apple juice with the increased cost of apples. This does not, however, imply that "shortages" or "cost increases" lead to inflation. In a market economy, everybody's price is someone else's cost, and vice versa. For the overall price level to increase, we need money. But it is important to emphasize and keep in mind that shortages of some goods - as we observe them today - do not lead to inflation.

So what leads to inflation? Scarcity determines individual prices. This is a fundamental law of economics. It explains why diamonds are expensive and water is cheap. It also explains the value of money. And the value of money determines the general price level - and how this level changes, that is: the rate of inflation.

Money was "invented" thousands of years ago because an economy in which people trade goods for goods is tedious. Suppose the baker wants some apples but the apple farmer does not want bread.

Then they must find some middleman who wants bread and has something that the apple farmer wants.

In the example here, suppose the baker can sell his bread to someone for one pear and the apple farmer is willing to trade his four apples for one pear. Then the exchange between bread and apples becomes possible and prices are expressed in terms of pears. Two loafs of bread as well as four apples are both worth one pear.

But of course, it is difficult to find some middleman with the right set of goods to enable the transaction. Hence, people quickly invented money.

Money is the best substitute for such a middleman.

The two farmers can sell their bread and apples in exchange for money - with which they can buy whatever they want.

Notice that money is a commodity in the sense that each coin (or banknote) is identical in value to all other coins with a similar denomination.

The value of any commodity, like copper or oil, depends on supply and demand - both today and in the future. If people expect a shortage of copper - due to increased demand or reduced supply in the future - the price of copper will increase today. This insight will become important later, when we discuss increases in money supply and expectations of inflation.

But first, back to the fundamentals. Money is important for an economy to work properly. It facilitates all market transactions between individuals. But that is just one of the functions of money. In addition, it serves as a unit of account (we can express prices in Euro, for example) and as a store of value. Inflation weakens money's ability to perform its three functions: First, the ability to store value erodes, then (if inflation is really high) the other two functions are no longer performed well either.

While there have been many forms of money (shells, rocks, salt, etc.), the first "modern" form of money came in the form of coins. These were made of silver, gold, or some other precious (scarce!) metal. And usually the domestic political leader - emperor, king, prince - was the only person allowed to mint such coins. Put simply, the government had a monopoly on the production of money.

Unfortunately, political leaders have often had the desire to spend more money than they could create. Remember, the coins were made of some precious metal and the political rulers only had so much of that metal. When they got large amounts of additional gold - like the Spanish Empire from Mexico and Peru in the 16th century - the result was that more coins were minted.

But this increased the number of coins while the number of goods that could be purchased with those coins was stable. Money got less scarce and thus lost value.

In other words, prices increased, the rate of inflation accelerated. The quantity of money was inflated. This is where the word 'inflation' comes from.

Why exactly did prices go up? Suppose the Spanish government used the additional gold from overseas to mint more coins. With that money they paid additional workers and soldiers. But those workers and soldiers carried their coins to the farmers which did not have more bread and apples to sell. There were more gold coins relative to the amount of goods. Thus, buyers bid up prices. Inflation went up. And it is irrelevant whether the Spanish government itself purchased more goods or transferred the new gold coins to workers and soldiers.

Not every government, however, was lucky enough to find new cheap sources of gold or silver. But still, political leaders wanted to create more money. To do so, they often minted new coins which no longer contained as much gold (or silver) as before. These are called "debased coins" and they have the same effect as additional gold coins: there is more money chasing an existing amount of goods - and prices go up.

Whether the additional coins were debased or not, their increased number reduces the value of every single coin that already existed. And this worsens the functioning of money. Like milk that is diluted with water, it is no longer of the same quality. When governments create additional coins, they partially destroy the usefulness of money as a store of value because the purchasing power of each coin is reduced. Effectively, when governments create new coins they transfer some wealth from all coin holders to themselves.

So, for a long time inflation was easy to understand. Whenever political rulers who had a monopoly on the issuance of money created too much money (true gold coins or debased ones), inflation occurred. At the core, inflation has always and everywhere been a monetary phenomenon (as Milton Friedman famously said).

The price level in an economy is determined by the scarcity of money. Any large-scale increase in money supply leads to inflation - but it is a priori unclear which prices increase. It could be that the workers and soldiers prefer bread over apples and thus use their extra coins to buy bread, driving up the price of bread while the price of apples remains unchanged. If they spend some of the extra coins on apples and this happens at a time of a large apple harvest, even the extra spending on apples does not necessarily drive up the price of apples. In short, we can say that the price level will likely be higher with the extra coins but we cannot predict the price movements of any specific good.

Moreover, we can hardly predict when inflation happens. That is because as soon as there is more money, people can spend it or hoard it. The latter is what economists say when people keep the money and do not spend it.

The workers and soldiers in the example above could just keep their extra coins and not spend them for a while. Then there will be no inflation despite the extra money created. And when they spend the coins, they can spend it on bread, on apples, or any other good or service. Thus, inflation does not mean that all prices increase all the time. But the increased (or inflated) amount of money can lead to an increase (or inflation) in the general price level.

These are the fundamental principles of inflation and they have not changed. It is just that in today's world everything is a bit more complicated.

The Modern Monetary System

Modern economies no longer just have coins and banknotes. We have developed far more complex financial systems and it is easy to get lost in the complexity (see background). But while the details may be reserved for experts, everyone can grasp the fundamentals.

The first fundamental aspect to grasp is that monetary history has repeated itself numerous times. As Thomas Mayer pointed out in his 2022 book, central banks were often founded simply to finance public spending. Their issuance of paper money repeatedly allowed rulers to live temporarily beyond their means. The monopoly on legitimate use of force effectively grants money its value. With all incomes earned in a certain territory being subject to taxation and taxes being due in a certain currency, governments have a long history of using money as a political instrument. In this regard, the past is little different from modern times.

The second fundamental aspect to understand is the last period of high inflation in Europe and the United States. This occurred in the 1970s and 1980s. In Germany the general price level of consumer goods increased by 64% from 1970 to 1980 (source). This is equivalent to an annual rate of inflation of about 5.1%. In the US, annual inflation was on average 8.0% during the same period. In some years and European countries, the rate of inflation reached more than 20% (see indicators).

Why did this happen? Well, there were multiple causes.

- Money supply was increased substantially, in the US mainly to finance the Vietnam War and the Great Society programs.

- Fixed exchange rates between the currencies in the so-called Bretton Woods system implied that the increased supply of US dollars led to an increase in the supply of other currencies.

- Former US President Nixon unilaterally cancelled the direct international convertibility of the US dollar to gold. That is, the dollar was debased like the coins discussed above.

- Two oil price shocks occurred: from 1970 to 1974 the price increased by a factor of nine, from 1978 to 1980 it tripled again. These shocks were amplified when unions demanded higher wages as a result of higher prices (wage-price spiral, see background).

How did this period of high inflation come to an end? Most economists credit the former chairman of the Federal Reserve (the US central bank, Fed), Paul Volcker, with ending inflation. He came into office in 1979 and quickly cut the growth rate of money supply. Under his guidance, the Fed raised the federal funds rate to almost 20%. Put simply, money became expensive and scarce again.

This move illustrates how central banks worked basically up until 2008. They exist to back up commercial banks which take in savings and provide loans to companies and households.

In essence, commercial banks make money by paying lower interest rates on savings than what they charge for loans (the difference between the interest rates is called spread). Of course, this implies that banks only keep a fraction of savings (or deposits) in-house. So if for some reason many savers want to withdraw their money at the same time, a bank can run out of cash. To avoid this, banks must have an account at the central bank - which can in principle provide unlimited amounts of cash.

Why can central banks create unlimited amounts of money? Modern-day money like the US dollar, Euro, or Swiss Franc is no longer backed up by gold. Economists call these currencies fiat money. This money does not have any intrinsic value, it is not backed up by gold or anything with true value. Thus, fiat money can be created at low cost.

This generates the risk that a government prints too much money in order to finance government spending. To avoid this, the monopoly of money creation is not with the government but with independent central banks.

While the US President or European heads of state can appoint central bankers - like Jay Powell at the Fed or Christine Lagarde at the European Central Bank (ECB) - they cannot order them to execute a certain monetary policy. Moreover, central banks are forbidden to finance government spending. This is to ensure that money supply is limited, money remains scarce, and prices are stable.

In principle, these rules should ensure that money supply does not increase too much and thus inflation is kept low. The reality, however, is different as we will see later.

When governments want to spend more money, they must either raise taxes or borrow money in the capital market. But in this capital market they compete with households and companies which also seek to borrow money. Hence, governments must pay competitive interest rates - which can be high if investors worry about the government possibly not paying back.

When governments borrow money they issue so-called bonds. This is basically a piece of paper which promises the holder a fixed amount of money at some future date.

The difference between the money paid today (one pile of coins in the illustration) and the money returned in the future (two piles of coins) determines the interest rate.

The Swiss government, for example, can sell a 10-year bond today which is worth 1'000 CHF in ten years. It is important to understand that investors will typically pay less than 1'000 CHF for such a bond. This is because they want to benefit from the deal, be compensated for temporarily parting with their money, and because they do not know how much they can purchase with 1'000 CHF in ten years. If there will be inflation, 1'000 CHF today is worth more - it buys more goods and services - than 1'000 CHF in the future.

The less investors pay for a bond today, the lower the price of the bond, the higher the implicit rate of return on that bond. Put differently, lower bond prices imply that it is more expensive for governments to borrow money. In the example above, the Swiss government selling a 10-year bond has an obligation to pay 1'000 CHF in the future. The less someone pays for this bond today, the more expensive it is for the Swiss government to build up debt.

Of course, central banks could in principle buy government bonds as well - not directly (this is forbidden), but from commercial banks. With freshly printed money they can bid up the price of such bonds and thus make it easier for governments to borrow money. But remember, this should be restricted to avoid inflation.

With this setup, up until 2008 central banks were important but rather boring. And one can say they were intentionally boring. Their actions were supposed to be predictable. When the economy was doing badly - that is, we were in a recession - central banks cut interest rates and when the economy was booming they raised interest rates. The key idea behind this is that low interest rates stimulate the economy: companies and households want to borrow more, invest more, save less, spend more. All this raises demand for goods and services and gets the economy going.

What central banks did was largely described by the so-called Taylor rule: Raise interest rates when the economy is booming and inflation is high, lower interest rates when the opposite is true. The former chairman of the Federal Reserve, William McChesney Martin, summarized the role of the central bank as "taking away the punch bowl just as the party gets going".

But then came the 2008 financial crisis and everything changed.

Monetary Policy since 2008

When the financial crisis occurred in 2007-2009, the world economy shrank for the first time in decades. Central banks around the world drastically cut interest rates. In the US, the federal funds rate fell to basically zero and the ECB gradually cut its rate to zero as well (illustration).

However, this stimulated economies only to some extent: the US economy grew by about 2.5% annually from 2010 to 2015, but the Euro area economy fell into another recession (link).

For Europe, the situation was complicated. Because of the Euro.

The Euro was announced in 1995, introduced electronically in 1999, and as cash in the hands of people in 2002. This common currency meant that governments in countries like France, Germany, Italy, or Spain could issue bonds in the same currency. When they borrowed money, they could all promise bond holders to receive the same currency in the future.

This had a profound implication. As long as Italy, for example, issued bonds in Lira, investors who bought these bonds had claims expressed Lira and were concerned about the purchasing power of the Lira as well as value of the Lira against other currencies. The Italian Lira was a much weaker currency than, for example the Deutsche Mark (DM) or the Swiss Franc. Over time, one needed to have more and more Italian Lira to buy one DM or one Swiss Franc.

To compensate for the depreciation of their weak currencies, governments in Southern Europe had to offer high interest rates. But then came the Euro and this risk was gone. As soon as the Euro was announced in 1995, interest rates for bonds from Euro member countries converged to very similar levels. Until 2008, there was virtually no difference in the interest rate that governments had to pay on their debt. Greece or Italy could borrow money at the same interest rate as Germany.

But things changed in 2008. The deep recession not only triggered the monetary response described above (central banks lowering interest rates). It also had a severe negative impact on public finances. Governments collected less tax revenue because people lost their jobs and collected unemployment benefits instead.

In countries all over Europe, the level of government debt increased rapidly. This was particularly worrying in the case of nations such as Greece or Italy where the level of debt was high prior to the 2008 crisis.

Investors feared once again that bonds issued by Southern European governments might not be safe. After all, how much debt can a government have before it must default?

Starting in 2010, interest rates on Southern European government bonds increased - which caused a vicious cycle: the more investors doubted the safety of Greek or Italian bonds, the higher the interest rates they demanded (to compensate for the risk of default). But the higher the interest rates went, the more likely became a default by the Greek or Italian government. To break this vicious cycle, on July 26, 2012, the President of the ECB, Mario Draghi famously said:

Within our mandate, the ECB is ready to do whatever it takes to preserve the Euro.

And believe me, it will be enough.

With these two sentences (full speech here), the ECB made clear that it would buy - if necessary - any amount of government bonds issued by Euro member states. This calmed down investors but required the ECB to actually purchase government bonds. In order to (officially) not violate the rule that a central bank must not directly finance government spending, the ECB bought these bonds indirectly from commercial banks. The result has been that interest rates on government bonds - how much governments in the Euro area must pay to borrow money - have come down.

When Draghi gave his famous whatever-it-takes speech, he addressed a key weakness of the Euro area: no member country has its own currency. That is why each nation can, in principle, go bankrupt. In contrast, other nations like Japan or the United States can always print any amount of money needed. Draghi effectively granted highly indebted Euro member states the right to print as much money as needed. Subsequent statements by various officials from the ECB made clear that a Euro member state will not go bankrupt because, if necessary, the central bank will print new money and provide governments with credit.

This resembles a similar argument made live on TV by Alan Greenspan, former chairman of the US Federal Reserve. Earlier still, in his famous 1776 book "The Wealth of Nations", Adam Smith wrote on page 423, "The raising of the denomination of the coin has been the most usual expedient by which a real public bankruptcy has been disguised under the appearance of a pretended payment."

But which investor is interested in a "pretended payment"? Who was holding Greek bonds in the beginning of 2022 when they only yielded about 1.3% interest in an environment where the rate of inflation is much higher than that? The answer is that several financial institutions such as pension funds are forced to hold them. Current regulation requires them to hold safe assets and by definition Euro area bonds are safe. Many would call this into question, yet the European Commission does not.

Monetary Policy of the ECB: Price Stability?

Having to deal with three crises in just 12 years (financial crisis, European debt crisis, COVID crisis), many governments in the Euro area issued large amounts of debt. To support them and to avoid country defaults (except for those in Greece), the ECB created new money and bought government debt worth trillions of Euro (see money supply). Some critics argue that policymakers followed was is called Modern Monetary Theory (MMT): expand the fiscal deficit and finance it by expanding the central bank balance sheet. As Albert Edwards pointed out in September 2022, however, such policies should not be used with an economy at full capacity - which is exactly what the supply constraints brought about by the pandemic created.

The purchases by the ECB drove up bond prices and thus reduced the implicit interest rate that European governments must pay for servicing their high levels of debt. But repeatedly it raised questions about whether this monetary policy was in line with the mandate of the ECB which is stated in the Treaty on the Functioning of the European Union, Article 127 (1):

The primary objective of the European System of Central Banks (hereinafter referred to as "the ESCB") shall be to maintain price stability. Without prejudice to the objective of price stability, the ESCB shall support the general economic policies in the Union.

Most people would argue that price stability implies stable prices, no inflation. Hence, the ECB should prevent inflation which the Merriam-Webster dictionary defines as "a continuing rise in the general price level usually attributed to an increase in the volume of money and credit relative to available goods and services".

Yet, according to the ECB the definition of price stability has shifted over time. From "zero percent" (or price stability) in the Maastricht Treaty 1991, to "zero to two percent" in 1998, to "less than but near two percent" in 2003, to "two percent over the medium term" in 2021. The president of the ECB, Christine Lagarde, wrote in May 2022: "In the end, we have one important guidepost for our policy: to deliver 2% inflation over the medium term. And we will take whatever steps are needed to do so."

This shift from zero to two percent might seem like a small difference but we must keep in mind compound interest. Over time, two percent inflation has a substantial impact on the price level. Every 36 years, it doubles. This is the opposite from price stability. The Euro is losing its purchasing power (see background). The chart below illustrates that since 1999 the price level in the Euro area has increased by more than 60 percent. And this is based on the Consumer Price Index (CPI, see background) which neglects the sharp increase in asset prices.

The monetary policy of the ECB had a substantial negative impact on savers. Take someone in Germany who put aside 100 Euro (or 195 DM back then) in 1995. With a regular savings account this has grown in 25 years to about 138 Euro. Yet, the price level in Germany has risen from 100 to 157 in the same time span. Put differently, the real interest rate for ordinary savers was negative for a quarter of a century and is particularly negative right now.

And again, this calculation uses the CPI as a measure for inflation. But how accurate is this?

How to get low (official) rates of inflation

Few politicians want high rates of inflation. Indeed, there are multiple incentives to have a low official rate of inflation. First of all, voters do not like rising prices. Second, official rates of economic growth are pushed downwards if the official rate of inflation is high. Economists measure economic growth by looking at the change of real GDP which is the nominal GDP adjusted for inflation. Third, many government payments such as pensions or welfare benefits automatically adjust to the price level. Thus, a higher official rate of inflation increases government spending.

So how can the rate of inflation, as officially posted, be reduced? Two prominent approaches come to mind when we recall how the CPI is calculated (see background): alter what is included in the basket for calculating inflation and change the weights given to individual items in the basket. As an example, house prices have been largely excluded from the basket. Thus, some items that got substantially more expensive receive little or no weight in the calculation of the CPI. To get a sense of how much house prices and other asset prices increased, this website provides several data series (see indicators). Moreover, Flossbach von Storch provide an index for the Euro area which shows how much asset prices have deviated from consumer prices (measured by the HICP) since 2015.

In addition to leaving out asset prices, there is a second way to lower official inflation. The fixed weights of all items in the basket for calculating the CPI have been replaced by flexible weights. Why would that make sense? When some products become more

expensive - and thus would lift the official rate of inflation - one can argue

that consumers will look for substitutes. If beer becomes more expensive, some

consumers will switch to wine. They substitute expensive beer with cheap wine.

The same substitution happens when new technology creates completely new

products (Aghion et al., 2019). When we neglect this substitution behavior, so the argument

goes, the CPI suffers from a substitution bias. But notice what correcting for

this bias does: things that get more expensive receive less weight in the

calculation of the CPI.

In conclusion, the CPI is one measure of how some prices

move in an economy. It is not a comprehensive measure of inflation in an economy. Put simply, CPI ≠

inflation. CPI is a part of inflation.

Monetary Policy of the ECB: Inflation Targeting

Despite or because of the difference between CPI and "true" inflation, the ECB continues to aim for 2% annual inflation using the CPI. Aside from the upward shift in the inflation target (which is supposed to be zero), the ECB's current goal "two percent over the medium term" entails two problems:

- What is the "medium term"?

- Which prices are to be considered when measuring inflation?

The ECB does not fully specify what time period to consider for the "medium term". Neither does it say that years of, say, 5% inflation will be followed by years of deflation, if that was necessary to get the average down to two percent. The Fed has already ruled this out ("the answer to that is no").

To measure inflation, the ECB uses the Harmonized Index of Consumer Prices (HICP). As is shown on this website (see indicators), this measure does not capture all relevant prices in the Euro area and substantially understates the "true" increase in prices people face in their lives. The HICP largely neglects, for example, the fact that housing has become much more expensive.

Because consumer price inflation (measured by the HICP) largely fell short of the 2% goal (see indicators), the ECB has seen its mandate fulfilled. Hence, without violating its "primary objective", the ECB has been able to "support the general economic policies in the Union". This largely enhanced the role the central bank played for economic policy in Europe.

Instead of targeting money supply growth, the ECB and other central banks attempted to target inflation directly. As we observed during 2022, however, the inflation forecasts were completely wrong (see Indicators) and cannot be precise. Moreover, the impact of monetary policy on inflation is complex and not well understood, as John Cochrane pointed out in September 2022:

Central bankers who think they have any idea how all these boxes and arrows work, and how to

manipulate them, should reread Bob's unsung classic "on a report to the OECD" Lucas (1979)

once a week. A little humility would do us all good.

Both avoiding another public default and stimulating the economy was attempted by keeping interest rates low. Not long ago, even Greek 10-Year bonds traded at a yield close to just one percent - less than US bonds.

The Consequences for Inflation in Europe

The ECB has vastly increased money supply to purchase government bonds. But where is the inflation? Why have consumer prices been growing slowly until recently?

There are two important explanations:

- Most of the extra money is kept as excess reserve in the ECB (see money supply).

- The velocity of money has decreased.

For inflation to occur, money must enter the "real economy" and not just be hoarded at the central bank. When the ECB purchased vast amounts of government bonds from commercial banks, the latter got larger deposits at the ECB.

These excessive reserves (the blue coins in the illustration) will enter the real economy if households and firms started to invest and borrow more. Put simply, Euro money is not scarce anymore but it is currently hoarded like the extra gold coins in the example given earlier in this text.

In the modern world, we do not have gold coins but monetary aggregates (see background) and we observe that M0 increased much more than M1 in the Euro area (see money supply). This supports the first explanation for why inflation is still muted. Most of the extra money is hoarded.

Yet, M1 and M2 have also increased by far more than 2% annually since January 2008. In fact, the growth rate of M1 was close to 8% until recently.

So, why did consumer prices not increase faster than they did? The answer is that every Euro is used less frequently than in the past (see quantity theory of money on the background page).

Economists estimate the so-called velocity of money by dividing nominal GDP by the monetary aggregates. For the Euro area, we see that for both M1 and M2 there is a sharp reduction in the velocity of money.

The velocity of money is driven by many factors. When the money supply is increased substantially, it is common for the velocity to fall. However, if people expect the value of money to decrease, they will spend it quickly and thus raise the velocity. Put differently, if inflation expectations spread, we can observe a self-fulfilling prophecy and enter a vicious cycle: higher expected inflation increases the velocity of money, which in turn increases inflation.

So, most of the extra money supply did not enter the real economy. But some was used for the purchase of new goods and services as well as existing assets such as houses and company shares. Various indicators illustrate that the extra money drove up stock prices, house prices, and lately consumer prices. Inflation is here and it implies that the Euro no longer serves as a good store of value, which is one of the three important functions of any money.

Rising inflation since 2021

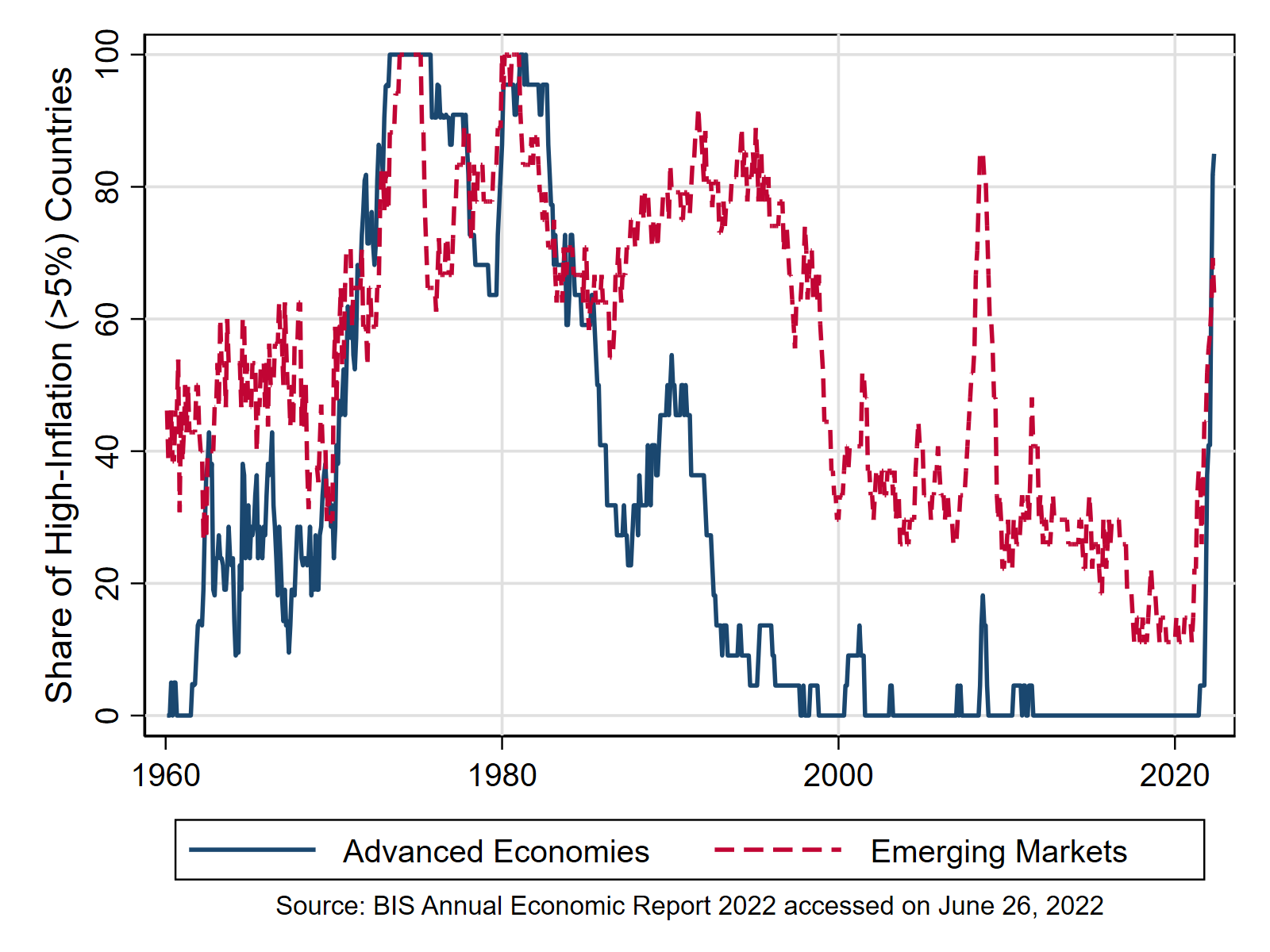

In June 2021, almost none of the advanced economies in the world had a rate inflation beyond 5%. But one year later, almost all are facing such inflation. What has caused this re-emergence of inflation?

As written above, the potential for high inflation has been created by increasing the money supply dramatically since the financial crisis. But why did it take until late 2021 for the extra money to lead to higher prices?

The answer is found in the distortions caused by the COVID-19 pandemic. Worldwide lockdowns implied that the supply of goods and services was temporarily reduced. Restaurants were closed, factories restricted in their production, supply chains disrupted. At the same time, governments tried to mitigate the economic downturn using fiscal policy: they paid companies to retain their staff (furlough schemes), provided emergency credit to firms, and handed out cash checks to people. All this indeed moderated the economic downturn but also kept demand for goods and services high. As soon as people were able and willing to spend again, the pent-up demand showed up.

With the supply of goods and services reduced but demand largely intact, there was upward pressure on prices. This includes the price of energy. One barrel of oil, for instance, sold for $68 at the beginning of 2020. The price then fell to less than $20 in April 2020 and global oil production fell substantially - by about ten percent. But as the global economy recovered from the pandemic, the price of oil surged to more than $120 in spring 2022. Roughly speaking, the price tripled from spring 2020 to a year later and then doubled again until spring 2022.

Similar price movements can be observed for other sources of energy such as gas. On the one hand, such developments are a temporary phenomenon. The oil price might increase sixfold in two years but will then settle at some level. The higher price incentivizes additional production, thus keeping a lid on how high the price can go. Hence, one could expect a temporary rise in inflation. As energy prices increase, so does the cost of production and transportation for basically all goods and services. This is why in late 2021 and early 2022 many central banks talked about high inflation being transitory. The rise in inflation was driven by food, energy, and transportation prices. Of the 10.6% inflation in October 2022, 6.1 percentage points were accounted for by these three categories.

But on the other hand, we know that the price

level of an economy is inherently unstable. Once prices start to rise on

a broad level, people and firms antedate purchases. Expecting prices to

increase further, they rather buy today than tomorrow. However, if many buyers

shift their consumption to the present, this creates additional upward pressure

on prices. Furthermore, workers ask for higher wages if they see the cost of

living going up. These second-round effects imply that we do not have a

transitory increase in inflation but possibly a lasting one.

What follows from these possible second-round effects is that inflation expectations matter. Economists often refer to inflation expectations as being anchored at a certain low level. When inflation is stable at, say, 1-2% a year for a long time, people expect the same level for the next years. Once, however, inflation is above this anchor level for a sufficiently long time, people "lose the anchor". This is what the Bank for International Settlements (BIS) referred to in its Annual Economic Report 2022: "We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched. This would mean a major paradigm shift."

Living with High Inflation

So it might be that we will face high rates of inflation for some time to come. What does that imply?

For individuals the question is whether their nominal income (or pensions, welfare benefits) increase at a rate matching or exceeding the rate of inflation. Otherwise, their real incomes decline. They can afford fewer goods and services as the purchasing power of the money erodes.

The last era of high inflation in Western countries, from about 1972 to 1982, illustrates the magnitudes. As the figure below shows, the Italian Lira, the British Pound, the French Franc, and the US Dollar all lost more than half of their value - their purchasing power - within one decade. During the same period, the German DM and the Swiss Franc - both known as stable currencies - lost about 40 percent.

For investors, inflation poses additional problems as we enter a new era. Since the global financial crisis, asset prices skyrocketed as a result of easy money. But increases in money supply are not like a flood that lifts all boats equally. Instead, investors target specific assets. Yet, asset prices as a whole have risen to unprecedented levels. Whether we consider the German DAX, the French CAC 40, or the Swiss SMI - they all reached all-time highs.

And while inflation generally is seen as a mixed bag - having pros and cons - inflation in asset markets is widely seen positive. When house prices or share prices go up, the gains in value, when realized, enhance profits. No surprise that there has been little opposition to the expansionary monetary policy from financial institutions and wealthy investors. They benefit. As Henry Hazlitt put it: "Those who have made money from speculation prefer to continue this way of making money instead of working for it. [...] The long-term trend in an inflation is toward less work and production, and more speculation and gambling."

Since the beginning of the ultra-loose monetary policy by the ECB and other central banks, asset prices have increased substantially (see indicators). The additional money that entered the real economy (recall that M1 has increased by more than 8% annually in recent years) was, however, not spent evenly across all assets. The implication is that some assets - certain stocks or real estate - gained enormously in value. Their owners become wealthy without any effort. Others noticed this windfall gain and sought to gain as well. As a result, more and more people have started to participate in speculative activities. Once prudent savers are putting their money into financial products they do not understand. This resembles the situation in Germany in the early 1920, beautifully described in the book "Dying of Money" (see background):

"Speculation alone, while adding nothing to Germany's wealth, became one of its largest activities. The fever to join in turning a quick mark infected nearly all classes [...]. Everyone from the elevator operator up was playing the market."

Now that consumer price inflation shows up, we observe two groups. One the one hand, consumers are upset about increasing costs of living. But for businesses the effect of inflation is often positive. Their debt and costs, expressed in Euro, lose value. Revenue grows faster than costs if the latter are temporarily fixed (wages are often fixed for a year or two in advance). But of course, this short-term gain does not last long. Contracts will be adjusted quickly, when unions and lenders require higher nominal payments due to increased inflation. This can lead to a wage-price spiral where businesses raise prices due to increased costs and workers require higher wages due to increased prices.

Fighting Inflation

As the year 2022 went on, in many countries rates of inflation increased to levels not seen in decades. The primary tool for fighting this development is for central banks to raise interest rates. One of the first to move was the Bank of England in December 2021, followed by the US Federal Reserve in March 2022. Somewhat surprisingly, the Swiss National Bank raised rates from -0.75 to -0.25 in mid-June 2022. Meanwhile, the ECB lifted rates by 50 basis points in July - for the first time since 2011 - and then by another 75 points in September and late October 2022.

By mid-2023, interest rates were at levels last seen before the 2007 financial crisis:

The Way Forward for the ECB

There are many negative effects that follow from the ECB's monetary policy and the resulting ultra-low interest rates. Perhaps the most important one is that they incentivize the continued build-up of debt. And public debt is already too high in countries such as Greece, Italy or Spain to afford a return to "normal" interest rates.

The ECB has entered a one-way street. Take Italy as an example. Public debt stands at 155% of GDP while government revenue is about 47.5% of GDP. This implies that for each 1% Italy pays in interest on its public debt, 3.3% of its public budget is consumed. If nominal interest rates returned to a level of, for instance, five percent, the nation would use 16.5% of its public revenue just to service the existing debt.

In reality, things are a bit more complicated. Italian bonds, for example, have an average duration of seven years (the median maturity, that is the point when half its outstanding debt comes due, is in around five years). Moreover, some government bonds (like 75 percent of those from Greece) are held by the European Stability Mechanism (ESM). This dampens the short-run effect of rising interest rates on the stability of public debt.

However, countries like France have issued many bonds with variable rates that increase in line with inflation. And expectations about future actions by the ECB play a crucial role for investors. Put differently, without the ECB's support several Euro members would face the threat of default.

This view was supported in March 2020 when Christine Lagarde, president of the ECB since November 2019, made a comment about the difference between interest rates on Italian and on German bonds - the so-called spread. On March 12, 2020 she said:

"We are not here to close spreads. This is not the function or the mission of the ECB."

In response to this statement, Italy's 10-year bond yield surged. It was less than one percent on March 3, then went to 1.17% on March 11 and peaked at 2.98% on March 18. The increase by more than 100 basis points was the biggest weekly rise since 1994. No surprise that Lagarde quickly changed her position. In fact, one can argue that the ECB has adopted a "stealth new mandate": the reduction of interest rate spreads - that is the difference between interest rates on German bonds and those of countries like Italy.

This view was supported by the ECB's introduction of a so-called "anti fragmentation tool" or as the ECB calls it, "Transmission Protection Instrument". Data from 2022 indicate that the central bank has sold maturing German and French bonds and used the freed up funds to purchase Italian and Spanish debt (see charts in the section Money Supply). The idea that the ECB has indeed followed this "new mandate" is supported by the Memorandum on the ECB's Monetary Policy (2019), published by former central bankers. It reads:

"There is broad consensus that, after years of quantitative easing, continued securities purchases by the ECB will hardly yield any positive effects on growth. This makes it difficult to understand the monetary policy logic of resuming net asset purchases. In contrast, the suspicion that behind this measure lies an intent to protect heavily indebted governments from a rise in interest rates is becoming increasingly well founded."

In simple words: The ECB's purchases of government bonds was in all likelihood intended to support countries with high debt levels. This resembles the behavior of many governments in history. Henry Hazlitt wrote in 1960:

"Our politicians, and most of our commentators, seem to be engaged in an open conspiracy not to pay the national debt - certainly not in dollars of the same purchasing power that they were borrowed, and apparently not even in dollars of the present purchasing power."

Earlier still, in 1776, Adam Smith wrote: "When national debts have once been accumulated to a certain degree, there is scarce, I believe, a single instance of their having been fairly and completely paid." He went on and explained that "the raising of the denomination of the coin has been the most usual expedient by which a real public bankruptcy has been disguised under the appearance of a pretended payment".

Such a policy has, thus far, required the ECB to purchase government bonds worth trillions of Euros. About three quarters of all new debt by Euro member countries was financed with new money. In the last two years, the ECB bought more bonds than the total net issuance of Euro zone governments. And it printed lots of new money to do so.

This vast expansion of money supply has enabled higher rates of inflation. In the past and in all sorts of countries, from the Roman Empire to the State of the Teutonic Order (1224-1525) that Kopernikus wrote about (see background). And the policies of the ECB are no different in their effect.

The Euro area could utilize the OMT (outright monetary transactions) program launched in 2012 when then-president Draghi promised to do "whatever it takes" to save the Euro. However, those highly indebted Euro members that could benefit from the program oppose it. Specifically, they do not want to comply with the accompanying conditions. But to trigger the ECB's power to buy sovereign debt under the OMT, a country must first have been granted a rescue program from the eurozone financial assistance fund, the European Stability Mechanism (ESM). Among others, Lorenzo Bini Smaghi, a former member of the executive board of the ECB, has argued that the central bank should be "light on conditionality".

Outlook

So, Europe is in for a period of higher inflation. And very economics textbook describes the biggest beneficiary of inflation: debtors.

In late 2021, global debt reached a record of $226 trillion. Public debt stands at 99% of global GDP, household debt at 58%, and non-financial corporate debt at 98%. This adds up to 256% of global GDP. Hence, the debt problem we see in Europe is a global phenomenon.

As the data presented on this website shows, for many debtors in Europe the alternative to an ultra-expansionary ECB policy is default. Historically, such sovereign defaults are common. Carmen Reinhart, a leading expert in the field, wrote in 2008:

"Governments that have repeatedly defaulted on their external debts, inflated away or outright defaulted their domestic debts, will, in all likelihood, not hesitate to default again."

Global debt has increased from 200% to 256% of GDP since these words were published. And it is even worse because debt-to-GDP ratios are sort of misleading: using the nominal GDP (= all goods and services produced in one year multiplied by their current prices) the debt-to-GDP ratio has the price level - and thus inflation - in the denominator. One should express debt to real GDP to see the actual burden and not allow governments to pay their debts with debased currencies.

The debt-to-GDP ratio is important because many refer to the 1970s when they discuss inflation. But this comparison, like every historical comparison, is not exact. The past was different from the present situation in many dimensions. It is important to recognize these differences because the so-called Volcker shock had severe economic consequences - as Paul Volcker wrote in his memoir. Stocks fell, interest rates surged to record levels, the unemployment rate climbed to 11 percent:

One important difference to the last episode of high inflation in the 1970s and 1980s is this: When Paul Volcker, former Fed chairman, raised interest rates and ended the period of high inflation, US public debt stood at 41% of GDP. Today it is 134% of GDP. Back then, interest rates of up to 14% on 10-year bonds were tough but feasible. They are no longer. Put differently, we currently do not have the tool available that ended the last period of high inflation. Debt levels are too high and public deficits for 2022 are forecasted to be 3.2% in Germany, 5.7% in France, or 6.1% in Italy. As long as public finances are not backed by tax revenue, the ECB faces a Catch-22: if it stops buying bonds, there is the risk of another European debt crisis - but if it continues buying bonds, public deficits and inflation remain at elevated levels.

Regarding the high debt-to-GDP ratios, we would first have to build that abovementioned tool to end inflation. One path is, somewhat ironically, a period of high inflation. If public deficits were curbed and high inflation erodes debt-to-GDP ratios, policymakers will again have the "Volcker tool". To see this, keep in mind that the debt-to-GDP ratio has the public debt in nominal terms in the numerator and the nominal GDP in the denominator. Inflation blows up the denominator (nominal GDP = price level times real GDP).

There is little doubt that today's high levels of European debt are unsustainable. Either there will be substantial defaults, or, more likely, this debt will be inflated away. This website, the European Inflation Tracker, aims to monitor this process.

As an economist, I must point out the difficulty of the situation. There is no painless policy option on the table. Decision-makers likely know that monetary policy is a macroeconomic tool and as such ill-suited to solve what are essentially microeconomic problems. The poor economic performance of European countries is the result of numerous microeconomic failures that cheap money will not fix. Structural reforms are needed for Europe to prosper. Cheap money only promises temporary joy. Restoring sound public budgets and healthy economic growth, however, is what matters.

Playwright Arthur Miller wrote, "An era can be said to end when its basic illusions are exhausted." The great illusion we see here was that Euro member countries like Italy would successfully use the time bought by then ECB president Mario Draghi's famous whatever it takes speech and trillions of cheap money from the central bank. Now that this era comes to a close, politicians should recall the saying "when there is no wind, row". It's time to row.

After twenty years of living with the Euro, Italians have the same GDP per capita (in constant 2015 US-dollar) in 2022 as in the year 2000. When they still had the Italian Lira, everyone was a millionaire (1 Euro was exchanged for 1'936 Italian Lira). This episode should remind us that paper money is not wealth.

And the difference between paper money and wealth matters because one of the key functions of money is to store value. But over long periods, most currencies do a poor job storing value. Consider the US dollar, which has existed for a much longer period than the Euro. Since 1913, the greenback has lost 97% of its purchasing power. Whoever wants to store value did better with gold or real assets.

Inflation worsens the functioning of money. In the Western world since the 1950s this has not happened to the extent that currencies lost their function as medium of exchange or unit of account. But as a store of value, the third function of money, basically all fiat currencies performed poorly.

Thus, to achieve a long-term preservation of value, people must hold real assets, not paper money. In savings accounts, one only indirectly invests in real assets as banks use deposits to provide loads for investment. As shown earlier, interest rates on savings are barely enough to keep pace with consumer prices. A better option is to invest directly in assets, diversified and at low cost. In this regard, there are plenty of options available for ordinary people today.

They should pay attention and be well informed because money matters for everyone and inflation is the enemy of money. Recently, inflation gained renewed interest. This website offers the public up-to-date insights into this topic. It provides illustrations, data sources, and further readings. My hope is to help people navigate in the difficult years ahead.

Stay tuned.